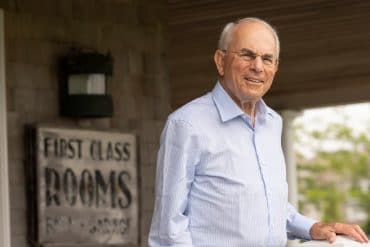

A conversation with Charles Schwab.

Charles Schwab is a summer resident of Nantucket and the founder and chairman of Charles Schwab Corporation. In 1975, when new legislation was introduced deregulating pricing in the brokerage industry, Schwab seized the moment and pioneered America’s first discount brokerage firm, revolutionizing the business in the process. Not only did the company disrupt an entire industry but it also democratized the stock investment world, attracting small investors in record numbers. N Magazine sat down with the soft-spoken and down-to-earth Schwab, who likes to refer to himself as Chuck. He shared with us how he started his business, obstacles he faced and his views on the future of the American economy.

N MAGAZINE: Explain your connection to Nantucket.

SCHWAB: Twenty years ago, my father-in-law had a home out here on Hinkley Lane that my wife, Helen, and I would come out to visit. When he passed away and the kids didn’t want to buy the house, it was sold. Eighteen or so years elapsed and we decided to come back and try a summer here because our summers in San Francisco were so cold. We came out here and found it was perfect weather.

N MAGAZINE: Nantucket has its share of successful people, but your level of success is unusual. What do you consider unusual about yourself that has led to this kind of success?

SCHWAB: Obviously luck and timing and all those things that you would read about in Malcolm Gladwell’s book Outliers. In my case, it was a benefit in a weird way of having dyslexia. There was uncertainty in my own mind about how good of a performer I could be in school. I was more humble and wasn’t very aggressive in my assertiveness, but I knew I had to work harder to compete. Studying any subject matter, I had to put more time into it and focus. Not being able to read as well or as fast as other people, I had to make up for it with other elements of determination. I really think it’s been profoundly important. I look back over time on how I persevered under some of these things — I just did. In some ways, it was a negative having dyslexia — but it turned into a positive.

N MAGAZINE: We often hear the term “business disruption.” Was this your intent in 1975?

SCHWAB: It wasn’t quite as refined as you might think, but it was about disruption. It was about changing Wall Street’s relationship with individual investors. With the help of the SEC and Congress, they changed the methodology of calculating commissions. They said it should be anything you want — it’s a free market. I liked that a lot, so we decided to provide a fundamental service to investors, pricing our services competitively and very low. We had quite a few customers at the beginning and it kept growing and growing. That’s the nature of the American free enterprise system — it’s always about disruption.

N MAGAZINE: Do you think that your approach to brokerage pricing increased the participation in the stock market by the average American?

N MAGAZINE: Do you think that your approach to brokerage pricing increased the participation in the stock market by the average American?

SCHWAB: Absolutely. Thousands of new investors came into the marketplace. Shortly after we introduced the discount commission-based system, Congress allowed IRA accounts to be opened up, and that became vast numbers of new people. It was a great combination of the two. We were inundated with new customers and new investors trying for the first time.

N MAGAZINE: Would you ever have anticipated that the market would be where it is today?

SCHWAB: With a little bit of calculating, you could see that with the natural growth we’ve had in the economy, we would reach those levels. You start compounding things that the economy generates. Individual companies, some incredible growth companies, disruptive companies growing at 40 percent to 50 percent per annum. Slide out your calculator and figure out how this compounding works, and you could come up with some big numbers.

N MAGAZINE: Putting President Trump’s personality aside, something is happening that is providing a lot of confidence and investment. Do you think Trump’s policies have a major impact on what we have seen?

SCHWAB: I think one of the most impactful things that has occurred in my business career was the tax bill. That really kicked off things. People really anticipated that when Trump was elected, that there would be some changes in the tax calculations for corporations and for individuals. Congress passed the most powerful tax incentive program for corporations that I’ve ever seen. So we are getting the benefit of it right now. There has been tremendous growth among individual companies and the economy’s growth should be close to four percent right now. It might not go on forever, but I think it has great legs, and we will see this enthusiasm of investors and the market itself play out for another year or so.

N MAGAZINE: What about those who feel that the economy has been artificially inflated on the back of cheap interest rates?

SCHWAB: Well, there’s some argument about the low interest rate period. Did it go on for too long? It may have. I argue that myself. It was very disruptive to the pricing of capital. It was so little for so long, and, of course, that was in combination with no fiscal incentives through the Obama years. Hence, we had pent-up demand, cheap money and few incentives. All of a sudden Trump came in and boom, we’ve got a really robust situation on our hands now.

N MAGAZINE: The biggest global economic change has been the emergence of China as a global economic force. How do you view China in our future?

N MAGAZINE: The biggest global economic change has been the emergence of China as a global economic force. How do you view China in our future?

SCHWAB: China is a conundrum to me. It’s a highly successful experiment in terms of the combination of a communist government releasing the power of free enterprise. The government is controlled by the Communist Party, but they’ve allowed people to make money and exchange money and do all these things with some limitations — certainly no free press.

It’s been very successful, but how they move forward is a real question. Can that platform integrate well with the rest of the world? We are going through this trade situation right now. I know firsthand how China makes their laws; they make them one way — so China succeeds, not you. Their thinking is very indirect, self-directed, selfish in our Western terms. Their system is completely different than ours. We are in a very critical moment today with what Trump is trying to do related to China. I think he’s doing the right thing. It has to be done otherwise we are going to be crushed.

N MAGAZINE: The intelligent transfer of wealth to children is a topic that interests many on Nantucket. What are your thoughts on how to maintain generational success when there is tremendous wealth?

SCHWAB: That’s a very complicated thing. Our family has been in the middle of it for a while, determining how to do the right thing. Number one: You don’t want to take incentive away from children to develop, educate themselves and do all the things you would like to have them do to have a fulfilled life. Do not destroy that incentive to fulfill their capabilities. In our case, some wealth gets transferred to kids, but most goes to foundations, philanthropies and charities.

N MAGAZINE: Can you summarize your philosophy on philanthropy?

SCHWAB: Fundamentally, I believe those of us that have had great success, financially speaking, have an obligation to the system to give back a substantial portion to philanthropic purposes or other good deeds.

N MAGAZINE: What are some of your passions outside of your career?

SCHWAB: We love contemporary art and that’s been very important to us the last thirty or so years — we get great enjoyment out of that. Running the San Francisco Museum of Modern Art as the chairman, as five to ten thousand people come a day to visit the museum, gives pleasure. It’s also fun to see success on the other end of the spectrum — to see kids that have been identified with dyslexia issues and learning disabilities find out that there are ways that they can cope better and can be successful in life. Studies they do in prison show that 50 percent of the inmates have dyslexia. They run off the path, they didn’t get the attention they needed in school, they end up going into drugs and alcohol and all the various negative things one can think of.

N MAGAZINE: As a businessperson, you are a long-term observer of the American economy, so what do you see in the next ten years?

SCHWAB: I’ve always been bullish on America. We still have a great system and structure. There are cracks in it in different places, especially today, but I think we can get through it because we have a common purpose. We want to have a functioning democracy, have a dialogue and speak freely. We are having some issues on that in some campuses and other places, but I think we will get through it. There are so many different ways to communicate that I think we will find the proper way to do so and still be friends at the end of the day.

N MAGAZINE: If you were a young person graduating from college or business school today, knowing what you know, would you enter the same field or is there another field that is more appealing or has a greater opportunity?

SCHWAB: Well, I wouldn’t search for the field. I think the first thing a kid has to figure out is what they are passionate about, what do they like to study, what do they like to talk about, what do they like to dream about. When you have a general area of thinking, then you can decide. Are there areas where I can make contributions to society? Can I make value and money at it as an entrepreneur? It’s up to you to decide what you really love to do. If you don’t love it, you’re never going to be successful anyway.